Startup culture is pretty much always heralded as a positive thing. Energetic, fast, mobile, responsive – these are all terms used to describe your average startup. But there’s a darker side to getting going, especially in the tech world. An awful lot of startups, now household names like PayPal or Airbnb, didn’t get to where they are 110% legally. We looked at the origins of four companies that have skirted the law to get ahead.

PayPal

PayPal started out in 1999, and by 2002 had gone public and been acquired by eBay for $15 billion. It was a win-win – eBay enthusiasts has a great way to pay for stuff and PayPal made a killing. Since then, PayPal has splintered off from eBay to be more PayPal-focused. They made $7.9 billion in 2014.

All in all, things are going pretty well.

PayPal isn’t a bank

And that’s a problem. A big one. See, banks have about a thousand and one rules, that they have to follow, all regulated by the federal government. And this is a good thing, because banks take lots and lots of people’s money and then give it to other people. It’s an inherently risky business idea that regulation makes incredibly safe. So huzzah.

None of those wonderful regulations apply to non-banks like PayPal though. And here’s why it’s a problem. PayPal is currently being sued, and has been sued by a number of people in class-action lawsuits over:

- Terms of Use violations

- Freezing accounts to “prevent fraud”

- Holding funds for up to 90 days, sometimes holding them for as long as 180

- Absolutely horrendous customer service

A FDIC (the federal body responsible for insuring banks and decreeing what is/is not a bank) is the one who ruled PayPal a non-bank, which is why they don’t have to comply with any of these rules. But the situation got even worse. PayPal, being a pretty switched on company, decided that they would just put users money into FDIC-insured banks, so any money was off their balance sheets. This neatly ties up the problem that if someone’s account is defrauded or robbed, the FDIC-insured bank will pick up the tab to the tune of $250,000 per user. But California changed their rules saying that PayPal wasn’t allowed to do that anymore.

The situation is that PayPal has a boatload of money on their books, there is no regulation, and it’s all uninsured.

How this helped PayPal

This all seems like it’d be pretty bad for PayPal. Not so. A big part of the reason for PayPal’s success if that they’re ‘the guy.’ What I mean is they’re industry standard. For anyone running an online business, from an ecommerce site selling hockey jerseys from China to a freelance graphic designer, clients expect PayPal to be the way to pay.

Like a social network, the value of PayPal is that everyone uses PayPal.

And the reason everyone uses them? Well back in the day, they had the jump on banks because they could keep their costs just so, so low. Banks needed to provide a huge range of services, including actual branches, fraud coverage, insurance per transaction – the downside to regulation is that it’s actually really expensive. So established financial services couldn’t hope to emulate the PayPal business model, because that business model relied on huge traffic to make a profit. And huge traffic wasn’t something that banks could (or can) do.

By changing the rules of the game, PayPal created a niche for itself. And granted – for the most part, PayPal hasn’t actually broken the law that often. But like all the startups we’re talking about, it knowingly skirted it more than a little, with financial gain being the end result.

Airbnb

Airbnb is a great idea. People want to travel, but they want to stay somewhere nice when they do. They want the comforts of home, when they’re out and about. Airbnb lets people do that, by letting people “Rent unique places to stay from local hosts in 190+ countries.”

https://www.youtube.com/watch?v=SaOFuW011G8#t=79

It also lets them host their own beautiful homes to fund future travel ventures. So what’s the legal question?

As it turns out, not just anyone can host people. Hotels, hostels, bed and breakfasts – they all have to comply with a whole lot of legal requirements, mostly around zoning and taxes (like New York City Hotel Occupancy 5.875% tax). Airbnb gives people the chance to nicely duck out of that, and they do it knowingly. Take, for example this exact fight in NYC, where a report found that 75% of all Airbnb residences were violating at least one law or another. The same report said that 37% of revenue from Airbnb was going to 6% of hosts.

The picturesque model of a young couple renting their home while they explore the world just isn’t a reflection of reality.

Instead, it’s landlord who have excellent properties that they can rent for more money through Airbnb than they can to people who actually live somewhere, while simultaneously avoiding higher taxes.

This is beginning to change, with silly terms like “peer-to-peer home sharing” in San Francisco being coined to permit Airbnb to do its thing. European cities have followed suit. And while this mitigates the advantage the Airbnb had for a long time (affordable travel in part because it wasn’t taxed) it still had a good six years of skirting the law to really entrench itself.

How this helped Airbnb

It’s the same story with PayPal – it let Airbnb offer a great service on a budget. Granted – they were helped because they didn’t have to pay to actually host, nor did they have to have the capital to buy and run a hotel or hostel.

A huge part of the Airbnb value proposition is that it is cheap.

And it is cheap in part because it wasn’t taxed (hotels pay 15% in San Francisco). Sure, part of the appeal is that you got to stay in someone else’s home. Awesome. But at the end of the day, my hunch says that dollars spoke louder than the experience.

The flipside of this is that Airbnb has done a lot to clear the way for other companies to come in and offer the same services, and continues to take the brunt of the legal fallout. But they also do a tremendous amount of business. All I can say is that their gamble with the law paid off.

Amazon

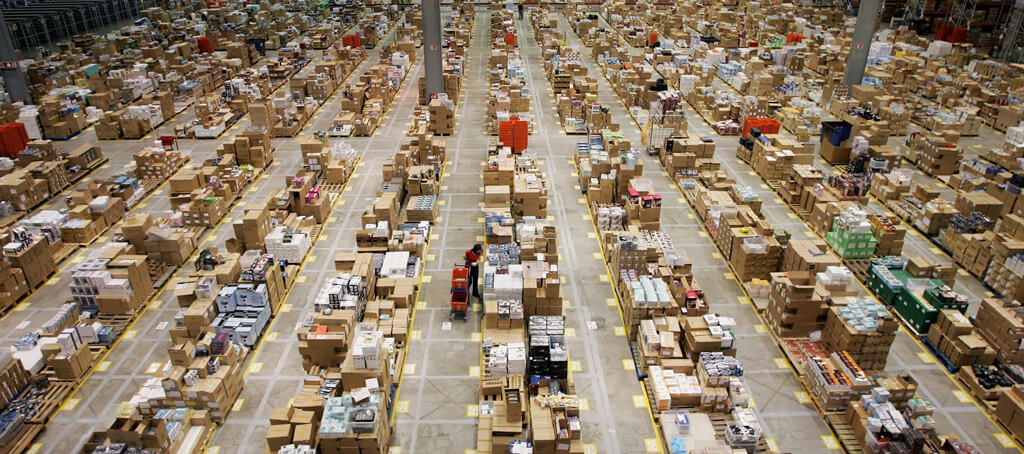

Amazon’s got an amazing business model – make no money on a lot of things, and make next to no money on a lot more things, and just sell a huge, enormous crazy-insane high number of things. That’s it in a nutshell really. They have some of the thinnest margins in retail (either e-commerce or brick-and-mortar) and the continually work to reduce costs (just take a look at their warehouses). But they also have a huge advantage over local businesses, aside from lower operating costs: they don’t pay any state sales taxes.

Image via Flickr

Amazonian tax evasion

Ok it’s not really tax evasion. The ruling goes back to 1992 (we’ll get recent events in Illinois and New York shortly) when the world was a very different place, and cell phones looked like this.

Image via Flickr

The ruling left it pretty vague, but generally agreed that you only have to collect sales tax in the state that you’re in. Let’s say, for example, that I live in New York and buy $100 worth of vintage sunglasses from a store in California. The store wouldn’t have to charge sales tax, because I live in NYC – likewise, I wouldn’t have to pay it.

It’s pretty obvious that in a business like retail, where price is everything and competition is fierce, an automatic 8 or so percent price difference is going to help your business.

A lot. In a strict market sense, it’s better for consumers because you pay a lower price. But in reality, it reduces tax bases, makes local businesses struggle more in an already uphill battle, and means that companies look like they have lower prices than they actually do.

However, this is beginning to change. Illinois and New York both now require Amazon to pay sales tax, even if the seller is outside of the state. So when I buy my $100 of vintage sunglasses, I’ll have to pay $108.88, to account for the 8.875% sales tax.

How it helped Amazon

It kept costs low and, like PayPal, let Amazon establish itself as the everyday low price alternative online. It’s pretty amazingly beneficial to them to have a leg up on in-state stores, before someone even gets to the checkout. And naturally, they fought the ruling in New York as much as they could, since they stood to lose a substantial chunk of their pricing more or less overnight. Fortunately the laws in Illinois and New York won’t inhibit businesses from selling online, since both laws (as well as the ones in California) have a pretty high threshold before they start getting taxed. They pretty much only apply to Amazon-sized companies and not Frank making wooden toy cars in his garage and selling them online.

Uber

As usual, I saved my favourite for last. Uber is just a cluster-fuzzle of legal woes stirring up trouble wherever it goes.

The problem(s)

Uber’s got a lot of legal problems, but their Archilles Heel is the battle over driver’s status. Currently, there is a lawsuit against Uber over whether or not Uber drivers (and Uber-like company drivers, for example Lyft) are employees or independent contractors. What’s the difference?

- Employees are protected with all the stuff you’d expect – minimum wage, antidiscrimination, workers’ comp, union rights – stuff like that.

- Contractors don’t qualify for any of that – they work on a contract for service basis.

While this seems like a pretty terrible deal for contractors, the flipside is that they get more freedom and more autonomy. A perfect example is hiring freelancers on a contract basis – there are pros and cons, like you set your own hours, but you aren’t guaranteed a set amount of money per week/month/year.

Where Uber enters this whole debacle is that it doesn’t take the good with the bad when it comes to their drivers (who are contractors).

It stipulates a whole bunch of things that they have to do, like maintain a rating of 4.5/5, or risk termination or ‘deactivation’. The legal battle is really over whether or not Uber is enough exerting control on its drivers to make them employees (spoiler: they are) while not giving them any of the benefits of being treated like employees. To further complicate matters, drivers are almost always contractors, not employees. Long haul truckers, for example. But then again, they don’t have to wear a uniform or maintain certain cab cleanliness.

Why Uber should be worried

Lets say that Uber has to re-class all its drivers as employees. This opens, like, a whole grocery aisle of problems for them. First, their cost per driver shoots through the roof. Second, they’re now liable for a range of problems like insurance, workers comp, and down the line probably some healthcare (all of which is good for people, but pretty pricey). Third, their massive rate of expansion would absolutely have to slow. Right now they can launch in a new city and just sit back and wait. But with employees, they’d have to sign dozens of contracts, negotiate labour laws, renegotiate in cities where they currently are – this decision can potentially change the entire Uber business model, and could even sink the Uber battleship.

However.

Another scenario is that they just work out the kinks and keep hiring drivers as independent contractors. When reaching the critical mass a network service like Uber needs is everything, by deciding to fight this out now, rather than getting approval to start, Uber might just slip through this whole issue and emerge bruised, but safe. By sacrificing the law early on, they got a toehold. And sometimes, that’s all you need.

What this all means

So is it ok for companies to skate, slither, and slide around the laws that bind normal companies in the name of innovation? Sure, it might be wrong, but in the case of Uber, you might say that someone had to do it. If it wasn’t them it would have been someone else. Or with Amazon, where the behaviour is actually leading to an improvement in legal regulation of a hitherto-unregulated industry, maybe it’s a good thing that they pushed the law – the law pushed back. It’s probably not a good idea to found a startup that hinges on the fact of operating outside or on the line of a law. But when you do, you might actually improve the legal system for the better.

You better be prepared for the fight though.